Proposition 15 will amend the constitution to increase property tax on businesses. This proposition’s passing will help pay for critical public services, libraries, fire districts and access to education by funding our community colleges.

According to an article published by SFGate on Oct. 13, “If Prop. 15 passes, commercial and industrial properties, except those zoned as commercial agriculture, would be taxed based on their market value. Property owners with less than $3 million in holdings would be exempt and would continue to be taxed on the purchase price.”

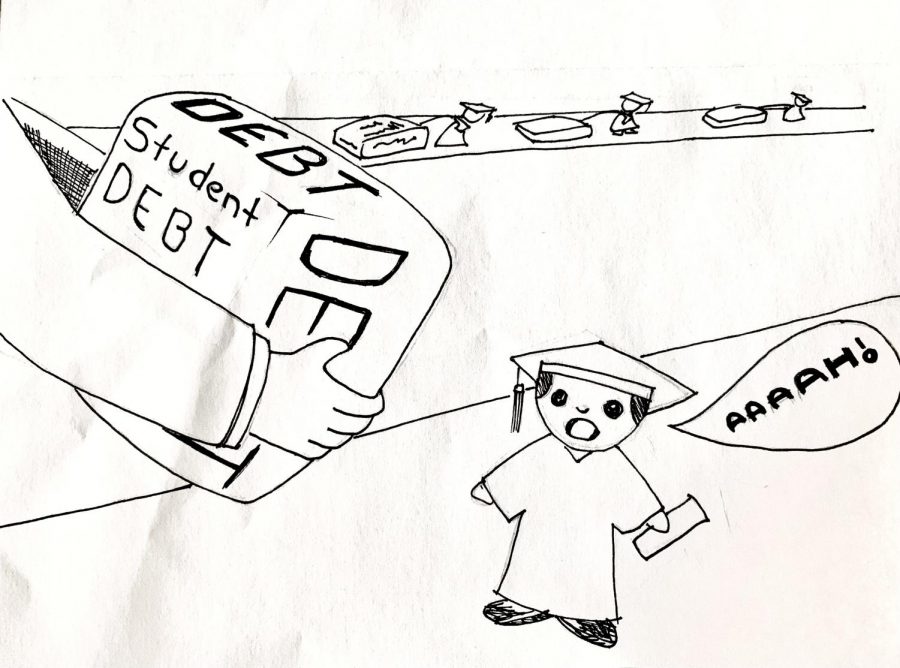

In 1978, Proposition 13 passed, imposing a cap of 1% of the purchase price on property taxes and stated that appraised values could not go higher than 2% each year until the property was sold or changed ownership.

A property’s value increases faster than 2% per year in California, most properties’ assessed value is less than their market value.

Commercial and industrial properties change ownership less often than residential property. So, the primary beneficiaries of this law are commercial property owners.

In an article published by The California Globe, on Sept. 12, Gov. Gavin Newsom was quoted as saying, “It’s consistent with California’s progressive fiscal values, it will exempt small businesses and residential property owners, it will fund essential services such as public schools and public safety, and, most importantly, it will be decided by a vote of the people.”

According to the state’s fiscal analyst, revenue from commercial property taxes could be $8 billion to $12 billion per year.

Critics fear that raising taxes will increase the cost of living in the state and the already high rent. But, this initiative may also positively influence the real estate market, forcing property values to eventually drop, which will also drop the risk of incrementing rent.

Prop. 15 should pass. Our communities and schools will significantly benefit from the measure. Yet, the government must implement additional efforts to avoid excessive increments of rent.

Walter Wilson, a principal at the Minority Business Consortium, was quoted in San Jose Inside News website on Oct. 14 as saying, “The whole idea is that this is not the time to raise taxes on taxpayers, but this is the time to raise corporate taxes on corporations that have been getting away, for … 40 years, with billions of dollars in taxes that should have gone back to our communities and schools.”

Wealthier companies and businesses should pay property taxes based on the actual value of their properties. Small business property owners and homeowners are exempt.

It’s absurd that sometimes, homeowners struggle to pay property taxes, while wealthy corporations get the easy way out . It is time for a fair deal that supports our locals.

The funds are needed to keep crucial jobs such as, firefighters, teachers, community college professors.

Vote Yes on Prop. 15 and help fund our community and schools first.